Swiss banks hold a certain cachet about knowing good from bad investments, and currently the hottest topic on their lips are ESG funds.

ESG stock options – or, rather, ‘Environmental, Social and Governance sustainability’ – have been steadily gaining traction among investors in the last few months, emerging into something of a buzzword.

Once considered a ‘hippie tree-hugging’ concept, ESG funds are having a moment in the sun (hopefully a sustained moment…). And, in December, they’re likely to have more of a moment still. After all, this is the season of charity and goodwill to all. Wouldn’t it be nice to ensure that our investments were in line with ethical corporate behaviour and preserving our planet?

But ESG investing is far more than just putting money behind nice people. It can make sound financial sense too, according to the big players.

Expert opinion

For Marriott’s Dividend Growth Fund, which has a solid track record, it’s less about ESG for ESGs sake and more about the fact that companies synonymous with sustainability practises and good governance tend to also have more solid predictors of success in the market.

“Marriott’s investment team monitors and reports on ESG issues on a regular basis. An area of particular importance to Marriott relates to company reporting and disclosures. Companies with a reputation for withholding important shareholder information will not be considered for inclusion in a portfolio as the future prospects of these businesses cannot be determined with a high degree of certainty. Companies which take advantage of ill-informed consumers are also immediately excluded, not only from an ethical standpoint, but also due to the unsustainability of exploitative business models. The Marriott team also carefully consider environmental initiatives undertaken by companies to ensure their products and future business prospects are sustainable.

“Studies have shown that companies which pay, and grow, their dividends tend to outperform the market over the long term. This is evident in the performance of Marriott’s local equity fund – the Dividend Growth Fund – which has won a number of awards for risk-adjusted returns,” said Marriott’s Robin Hartslief in a recent press release about ESG funds.

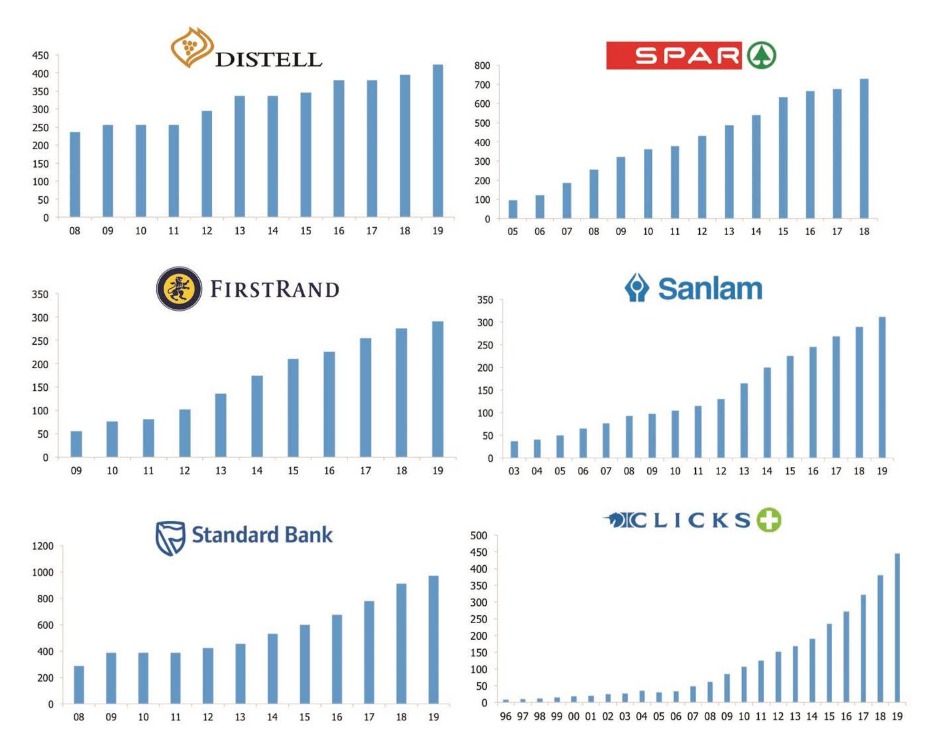

The charts below illustrate the dividend track records of some of the companies the Marriott Dividend Growth Fund currently invests in. As you can see, it pays to be the nice guy:

ESG in the rest of the world

Overseas too, the Financial Times noted this month that ESG tends to seriously outperform in some key areas. “ESG assets under management have grown the fastest among smart beta strategies, at a compound annual growth rate of more than 70 per cent over the past five years, according to a recent report from Bank of America Merrill Lynch,” it said. In Europe, Lipper EMEA Research noted that “we have witnessed an above average increase of assets under management driven by market performance. Additionally, a high percentage of the overall net inflows in the European fund industry are invested in mutual funds and ETFs with a sustainable investment approach.”

ESG funds offer exciting opportunities for investors. They are still a tiny portion of the market in SA with not much but the fact that they’re a buzzword known about them when it comes to the average investor.

Just like with any other change in investment strategy, this requires a comprehensive conversation before making any switches, but if you’re looking for new options – ESG funds could be a great addition to your portfolio.